How to Calculate Gross Profit Using Fifo Inventory Costing Method

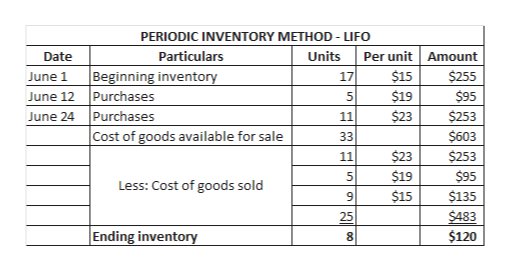

Calculation of Gross Profit Periodic. Therefore we can see that the balances for COGS and inventory depend on the inventory.

Inventory And Cost Of Goods Sold Fifo Youtube

Unit of Goods sold.

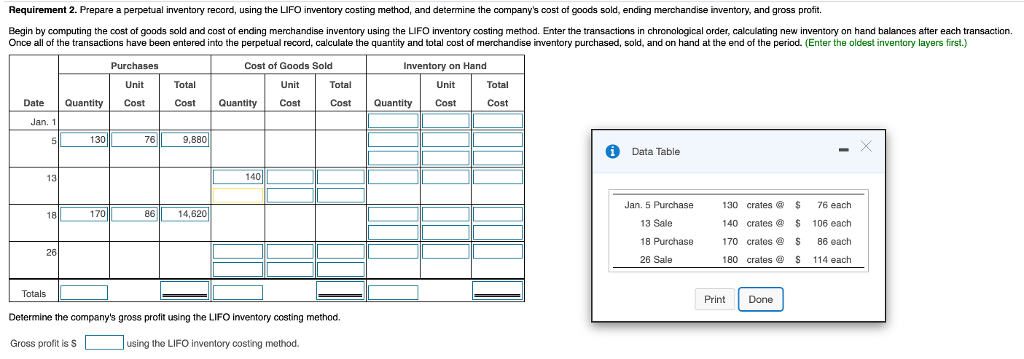

. Calculate the value of Bills ending inventory on 4 January and the gross profit he earned on the first four days of business using the FIFO method. We need to prepare a perpetual inventory card using LIFO method to find ending inventory cost of goods sold and gross profit. Remember that as prices rise FIFO will give you the lowest cost of goods sold because the oldest and least expensive units are being sold first.

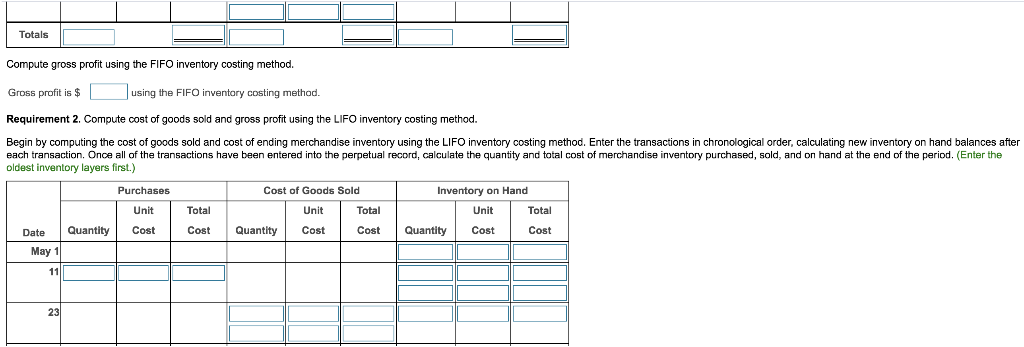

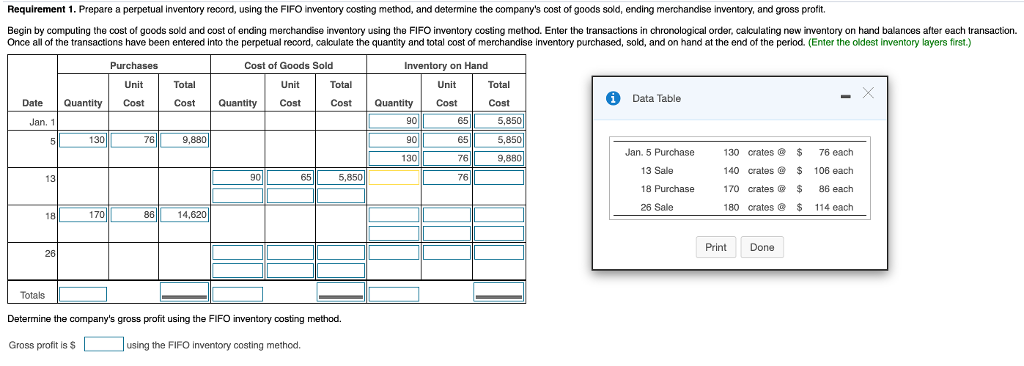

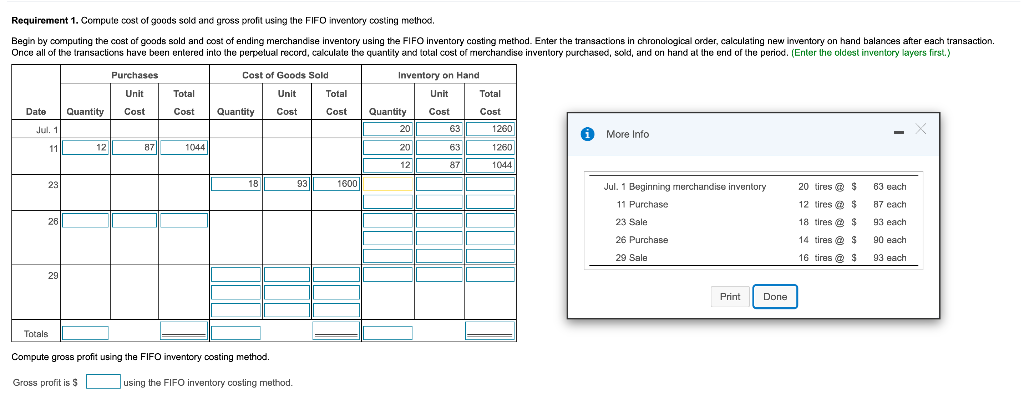

Compute cost of goods sold and gross profit using the FIFO inventory costing method Begin by computing the cost of goods sold and cost af ending merchandise. Add together the cost of beginning inventory and the cost of goods purchased during a. Mikes cost of goods sold is 930000.

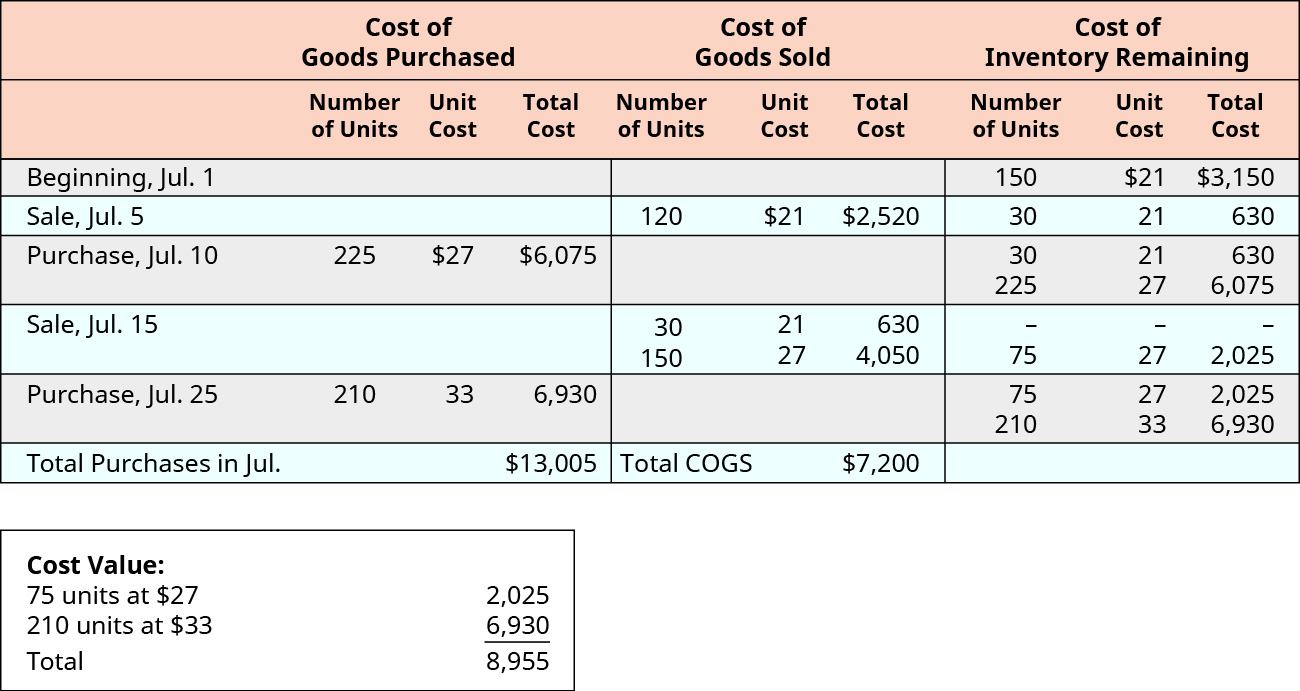

Multiply the result by 100 to convert the result to the gross profit percentage. Calculation of First In First Out method. According to the FIFO method the first units are sold first and the calculation uses the newest units.

To find the cost valuation of ending. Click to see full answer. 1000 Beginning inventory 2000 Purchased 1250 Ending inventory 1750 Units.

Cost of ending inventory under perpetual-lifo. How do you calculate gross profit FIFO. Calculating Inventory Cost Using FIFO.

COGS Cost of Goods Sold 100 20 150 20 100times20 150times20 100 20 150 20 Cost of Goods Sold FIFO 2000 3000. Find the ending inventory. Inventory 700.

Follow these steps to estimate ending inventory using the gross profit method. Assume a product is made in three batches during the year. Add together the cost of beginning inventory and the.

In this example multiply 03939 by 100 to find the gross profit percentage equals 3939 percent. Gross profit method formula. To calculate COGS Cost of Goods Sold using the FIFO method determine the cost of your oldest inventoryMultiply that cost by the amount of.

To calculate the gross profit method you need to follow these steps. 15000 - 6000 9000. The gross profit of 030 divided by the selling price of 100 means a gross profit.

The controller uses the information in the above. The gross profit method of estimating ending inventory assumes that the gross profit percentage or the gross margin ratio is known. Also simply use the online simple fifo calculator that helps you in understanding how to.

For example if a company purchases goods for 80 and. Calculate the gross margin for the period for each of the following cost allocation methods using periodic inventory updating. November 11 2019.

How to Use the Gross Profit Method. 300 units x 875 262500. In this example divide 13 million by 33 million to get 03939.

Add together the cost of beginning inventory and the cost of purchases during the period to arrive at the cost of goods available for sale. Here is how inventory cost is calculated using the FIFO method. Divide your gross profit by the total costs of goods your company sells.

So the ending inventory would be 1500 x 10 15000 since 10 was the. For example John owns a hat store and orders all of his hats from the same vendor for 5 per unit. To calculate FIFO First-In First Out determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold whereas to.

The gross profit method is a technique used to estimate the amount of ending inventory. This also gives us. Our gross profit is 292750.

100 units x 900 90000. Ending inventory using gross profit Cost of goods available Cost of goods. Example of FIFO Method to Calculate Cost of Goods Sold.

Ending inventory using gross profit. To calculate gross profit perpetual and gross profit periodic we take calculated inventories of FIFO from First in First out Method page and AVCO inventories from Weighted Average Cost Method page. How Do You Calculate FIFO.

Inventory 350. Calculation of Gross Profit Perpetual For three months ending 31 March 2015. Assume that all units were sold for 25 each.

Compute gross profit for August using FIFO LIFO and weighted-average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit 5200 FIFO 5500 LIFO 5260. Multiply 1 - expected gross profit by sales during the period to arrive at the estimated cost of goods sold.

First In First Out Inventory Fifo Inventory Accounting In Focus

Solved Requirement 1 Compute Cost Of Goods Sold And Gross Chegg Com

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

First In First Out Inventory Fifo Inventory Accounting In Focus

Solved Gross Profit Using The Fifo Inventory Costing Method Chegg Com

Fifo Vs Lifo Comparison Double Entry Bookkeeping

Answered Compute Ending Merchandise Inventory Bartleby

Small Business Inventory Management Lifo Vs Fifo Vs Average Cost Driveyoursucce

Solved Requirement 1 Prepare A Perpetual Inventory Record Chegg Com

Solved Requirement 1 Prepare A Perpetual Inventory Record Chegg Com

Solved Requirement 1 Compute The Cost Of Goodssold Cost Of Ending Course Hero

First In First Out Inventory Fifo Inventory Accounting In Focus

Solved Compute The Cost Of Cost Of Goods Sold Cost Of Chegg Com

First In First Out Inventory Fifo Inventory Accounting In Focus

Calculate Ending Inventory Using The Fifo Method Youtube

1a Ch 6 Gross Profit Fifo Youtube

Solved Requirement 1 Compute Cost Of Goods Sold And Gross Chegg Com

Calculation Of Gross Profit Using Calculated Inventories Of Fifo And Avco Basic Concepts Of Financial Accounting For Cpa Exam

Gross Profit Cost Of Goods Sold And Ending Inventory Fifo Youtube

Comments

Post a Comment